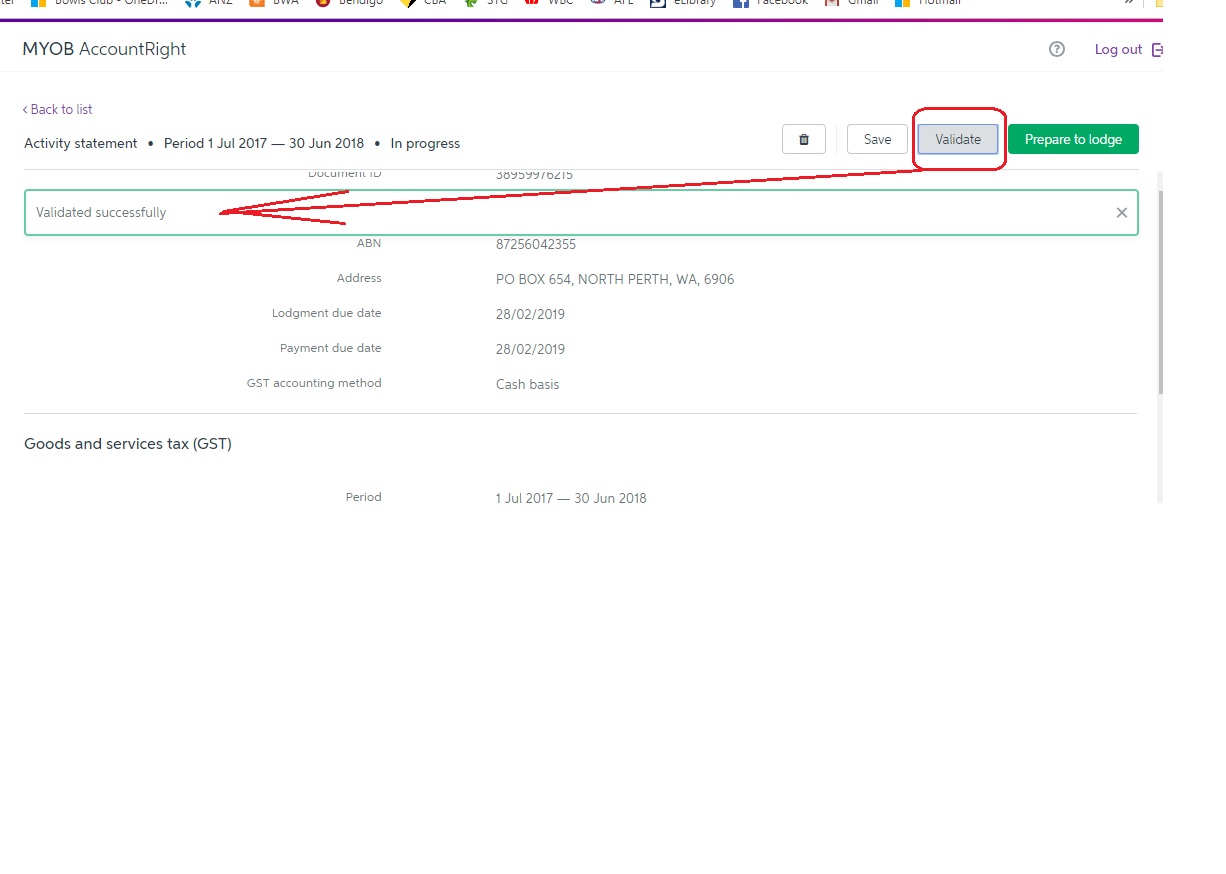

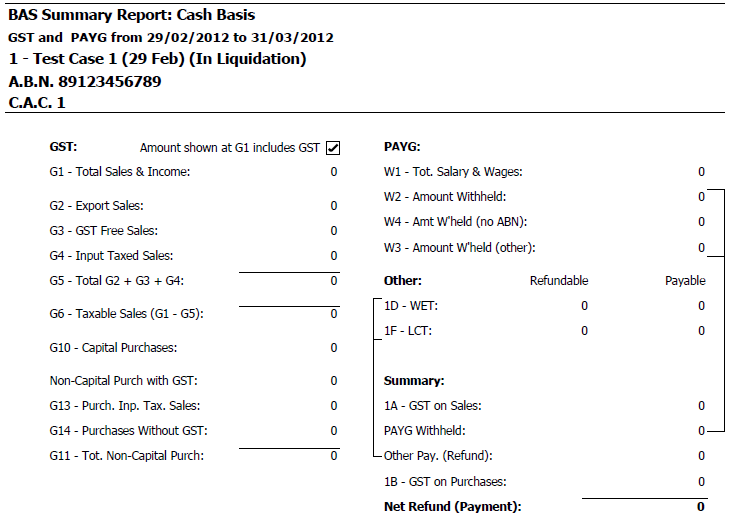

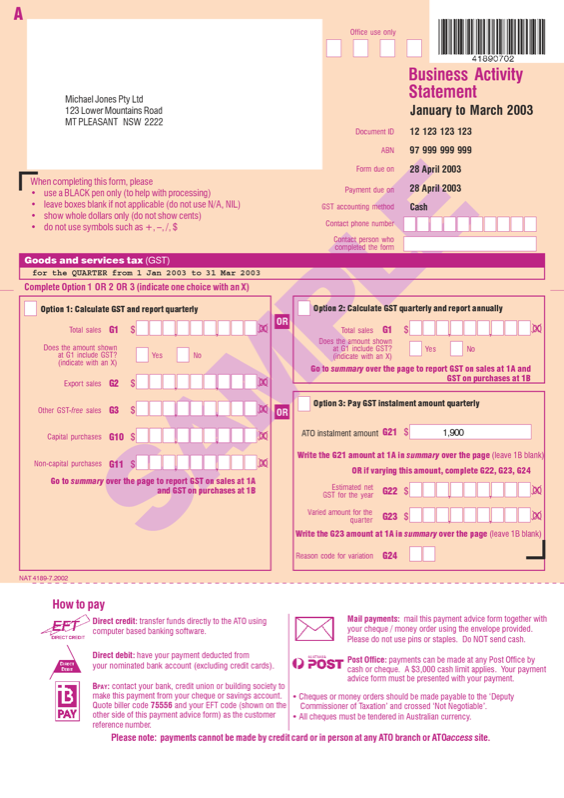

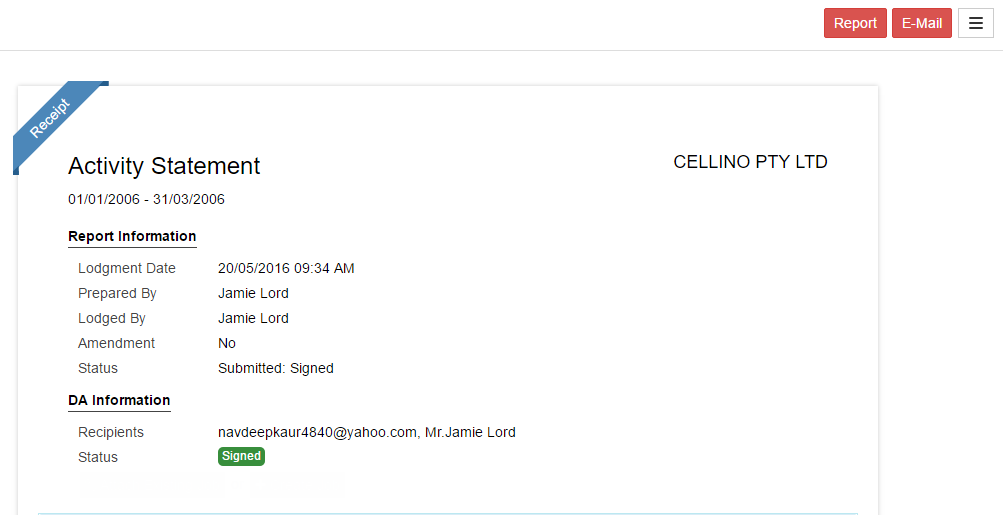

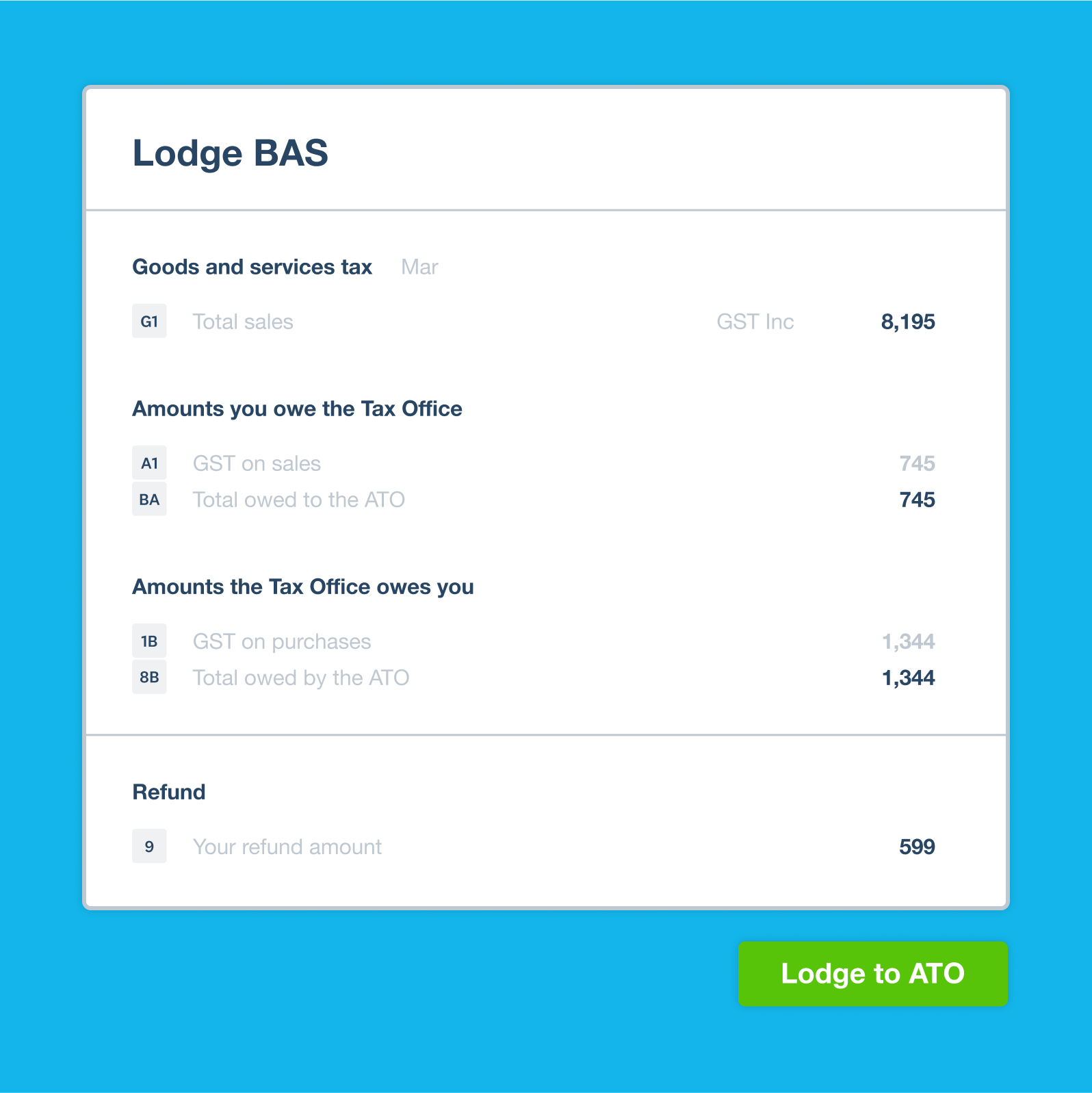

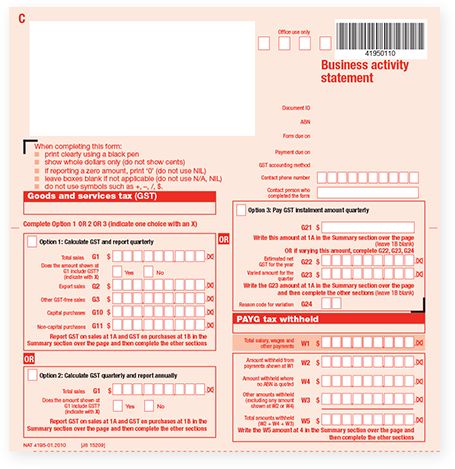

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

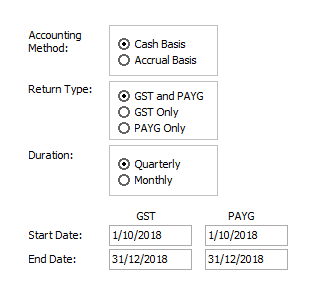

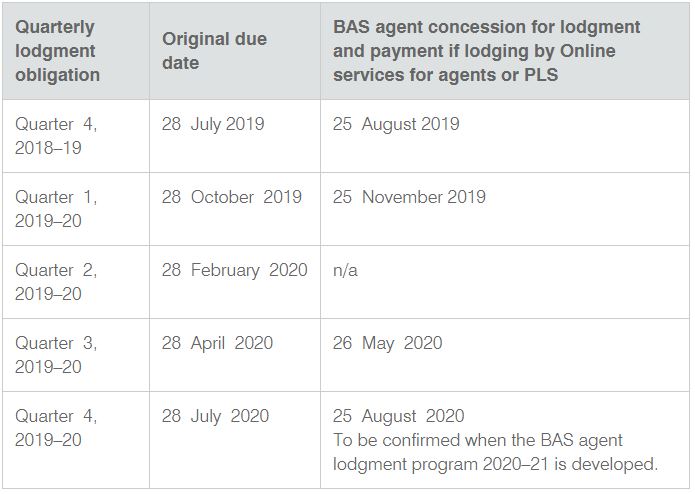

Balanix Solutions - October-December 2021 BASs lodgement date is 28 February 2022. If you need a hand, call Balanix Solutions on 3264 4783 as a matter of priority. #BAS #Tax #ATO #compliance | Facebook